Frequently Asked Questions (FAQ)

Agent Portal

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Agent Portal Overview

In this video, we will show you how to get around our own O’Neill Portal, where you will be able to manage your commissions, appointments and more.

Agency Management Overview

This video will show you how to use the Agency Management tab

- View downline Agencies and Agents

- Access downline agents’ portals to view appointment status or add appointment requests

- Modify Agency Settings

- Send Onboarding emails

How do I Request Appointments?

This video will show you how to request appointments via the My Appointments Tab

- Seeing current appointments

- Seeing all carrier appointments O’Neill Marketing offers

- Requesting a new appointment from a new carrier

- Adding a state to an appointment you already have with O’Neill Marketing

How do I access Carrier Bonuses?

View the actual PDF Bonus flyers carriers up out for each open enrollment

- You can view each carriers bonus flyer/flyers

- They will be here for reference so you can read the carrier fine print

- One important location to keep track of all carrier bonus information

How do I access Carrier Resources?

Use this tab to find carrier information such as

- Broker Support Phone Number

- Member Support Phone Number

- Links to Broker Portals

How do I access Commission Rates?

If you are wondering what your PMPM is for each carrier the Agent Portal has you covered

- You can view commission rates for appointed carriers.

- You can view commission rates for non-appointed carriers.

- See the commission rate for each carrier in each state.

How do I refer a Policy?

If you are not:

- Licensed in a State

- Appointed with a carrier

You can refer a policy to O’Neill Marketing.

We will only help the client with the product line you specify.

We will reach out within 48 business hours

How do I update my Banking Information?

This video will help if you need to change your banking information

How do I update my E&O?

This video will help if you need to change your E&O information.

How do I update my Personal Information?

This video will help if you need to change your:

- Address

- Phone Number

- Email Address

- W-9 Form

- Agent/Agency Logo

- Agent Headshot

How do I Update my Resident State License Information?

This video will help if you need to update information regarding your resident state license.

How do I access my Commission Statements?

This video will show you how to view your commissions.

You can see:

- Each carrier statement

- Monthly statements

- Downline reports

Qualifying Life Events (QLE's) and Special Enrollment Periods (SEP's)

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

If a client has a mid-year plan change due to a Qualifying Life Event, will their deductible reset?

Per carrier:

- Cigna: In the case of Cigna, a switch in plan due to a QLE will NOT affect the accumulation of the deductible regardless of the change.

- United HealthCare: In the case of UHC, if a client switches plans on the same metal tier, it will not reset. Otherwise, it will, unless they change using the “Below 150% FPL” SEP. In that case, the accumalation will remain intact regardless of the switch in metal tiers.

- Aetna: In the case of Aetna, deductibles will reset in all scenarios.

- Ambetter: In the case of Ambetter, the deductible will reset in every scenario. They would need to contact member services to transfer the accumulation from one plan to the other.

- Oscar: It transfers over. This also applies if they move to a new market. If they go from California to Arizona it will reset. New Jersey will be carried over if they are from Florida.

- Blue Cross Blue Shield Texas: In the case of BCBS TEXAS, If the client is changing from one BCBS plan to another, the deductibles paid in will transfer to the new plan, in all scenarios.

- Molina: The deductibles for Molina do roll over in all cases, unless they were to leave Molina for a time period and come back, then it does not.

Is the answer the same if they change metal tiers (i.e., if they change from Bronze to Silver)?

Carriers:

- Oscar: That will be carried over as long as they don’t move to a new State. It will only transfer over if they move to New Jersey.

Is the answer the same if they change plans using the under 150% FPL SEP?

Carriers:

- Oscar: That will also carry over if they are within the same State.

HealthSherpa

OM 2024 Carrier Guide for HealthSherpa

Agent Resource Center

HealthSherpa Export Report Guide

HealthSherpa Export Legend (For Admin users)

HealthSherpa Export Legend (For Agent users)

HealthSherpa FAQ

Regulatory Information

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

2024 FFM Guides

Click the links below to see our guides for agents

New Agents can use the video created by CMS shown below

For State Exchanges Please Reference Our Webpage Below

Agent of Record (AoR) Locks and Changes

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Aetna

Aetna confirmed they will be locking AOR after Open Enrollment (an email was sent to agents on 1/9/24). The last AOR on the policy during OEP will be locked as the AOR. The broker on file as of December 31st, 2023, will be locked as Broker of Record for 2024. For effective dates later than January, the broker on the first enrollment will be locked as AOR.

Changing AOR with Aetna: Aetna only has a “soft lock” for AORs, so any change that affects the policy number can result in a new AOR. This means that if the plan or benefits are changed, the AOR can also change. The AOR should not change if there is only an income change (without any corresponding plan or benefit change).

NOTE: Per a call with Aetna Broker Support (3/18/24), Aetna members can request an AOR change by emailing aetna-cvshealthIVLexchangesales@aetna.com from the email address they have on file (must be the member email Aetna has on file or else it will not work). The email must contain the member’s full name, address, phone number, and member ID. In the email, the member can request to remove or change their AOR. Aetna does not have a form members can fill out, so this is the only way to request this change.

Ambetter

Ambetter emailed agents on 12/5, saying that they will be locking AOR for Jan 1st effective policies on 12/31 – the agent listed as AOR on 12/31 will be locked for the year (to be safe though, we would still recommend agents check 12/15 and 12/31 to be certain). For Feb 1st effective policies and beyond, the agent listed on the first active enrollment will be locked as AOR. (In short: 1/1/ effective policies are locked in, checked on 12/31, 2/1 effective and beyond are first in).

Changing AOR with Ambetter: Ambetter has a “hard lock” for AORs. The only way to change AOR on an Ambetter policy is to change carriers – only changing plans or benefits within Ambetter will not change AOR. Once a client has been inactive with Ambetter for 30 days, they could switch back to an Ambetter plan with a new AOR. Before 30 days of inactivity, the original AOR will still remain.

Cigna

Cigna confirmed they will be locking AOR after OEP, but they are doing everything by the first agent submitting the policy. The first submission will be locked as AOR. (Though Cigna has said they will be locking the first AOR attached to the policy, to be safe it would be best if agents also made sure they are AOR on 12/15 and 12/31 – it may not matter but best to be safe).

Changing AOR with Cigna: Cigna has a “hard lock” for AORs. The only way to change AOR on a Cigna policy is to change carriers – only changing plans or benefits within Cigna will not change AOR. Once a client has been inactive with Cigna for 90 days, they could switch back to a Cigna plan with a new AOR. Before 90 days of inactivity, the original AOR will still remain.

NOTE: Per a call with Cigna Broker Support (01/12), Agents and members can request a Broker Designation Form from Cigna to switch AORs. This form needs to be signed by both the Agent and the Member. View Form Here.

Oscar

Oscar has said they will be implementing something within the next few months. Stay tuned for more info.

UnitedHealthCare

UHC has not implemented any AOR locks as of writing (1/10/24). For now, they are going by the 834 submission file, so changing only the income will allow an AOR change (even without plan or benefit changes).

Molina

Molina has not implemented any AOR locks as of writing (1/10/24). For now, they are going by the 834 submission file, so changing only the income will allow an AOR change (even without plan or benefit changes).

BCBS TX

AOR upon effectuation remains the AOR unless there is a benefit change or the policy is cancelled/terminated.

Changing AOR with BCBS TX: BCBS TX will not allow AOR changes within the first 60 days of a policy. After 60 days, they have a “soft lock,” so changing the plan or benefits will allow an AOR change (but not just a change in income).

Additional Information

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

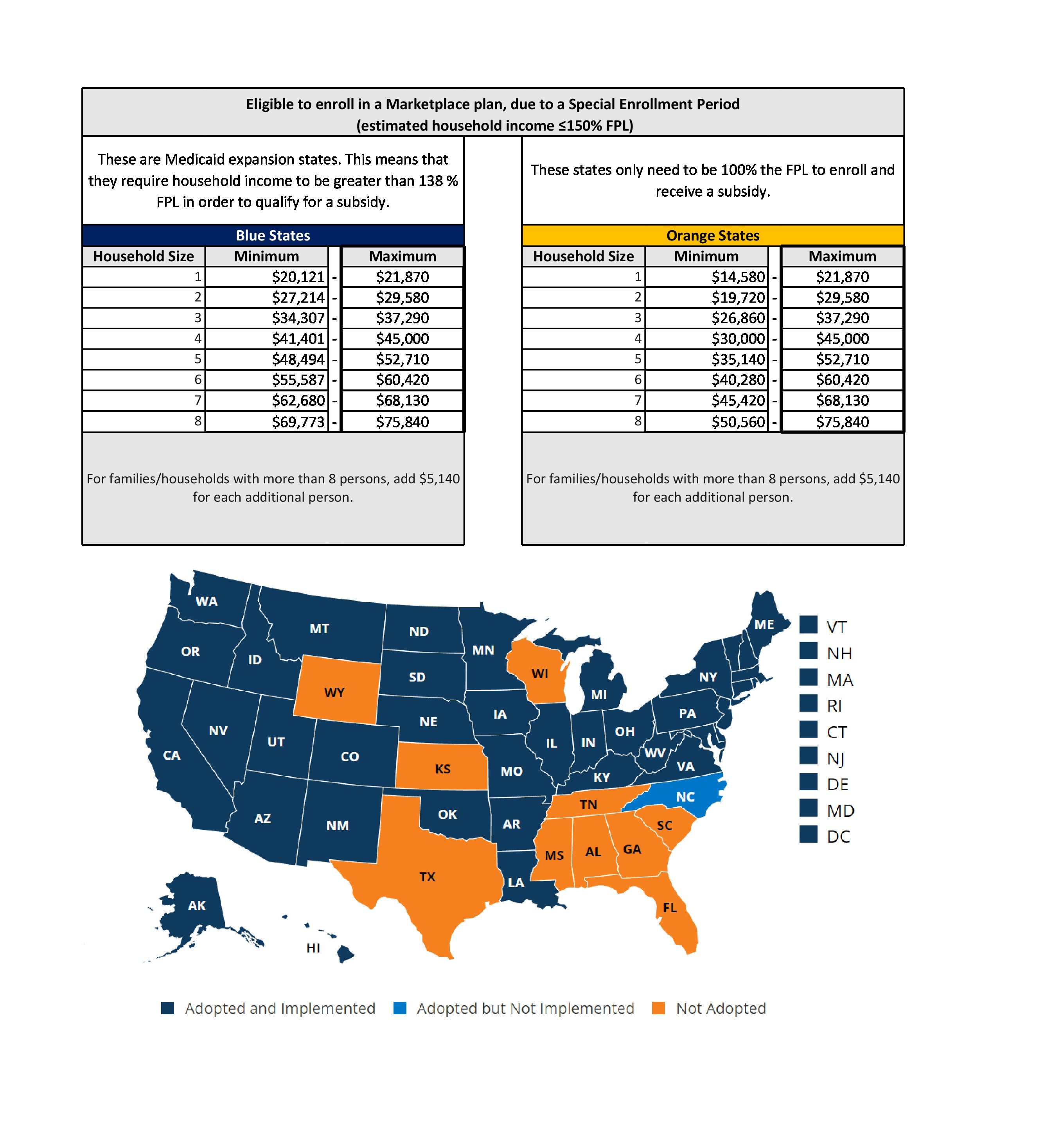

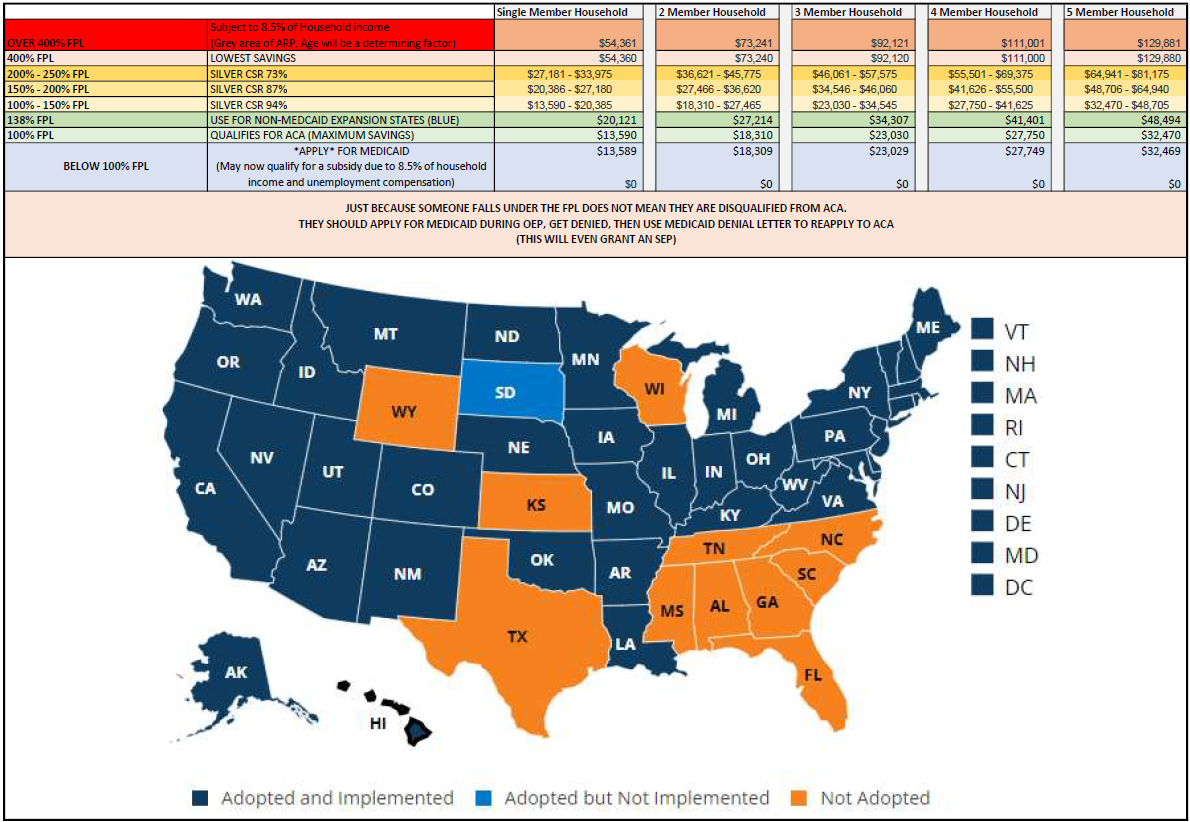

FPL Chart - 2023

Download: ACA Cheat Sheet with FPL Amounts

Federal poverty level (FPL)

A measure of income issued every year by the Department of Health and Human Services (HHS). Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage.

The 2022 federal poverty level (FPL) income numbers below are used to calculate eligibility for Medicaid and the Children’s Health Insurance Program (CHIP). 2021 numbers are slightly lower, and are used to calculate savings on Marketplace insurance plans for 2022.

Federal Poverty Level (FPL)

| Family size | 2021 income number | 2022 income numbers |

|---|---|---|

| For individuals | $12,880 | $13,590 |

| For a family of 2 | $17,420 | $18,310 |

| For a family of 3 | $21,960 | $23,030 |

| For a family of 4 | $26,500 | $27,750 |

| For a family of 5 | $31,040 | $32,470 |

| For a family of 6 | $35,580 | $37,190 |

| For a family of 7 | $40,120 | $41,910 |

| For a family of 8 | $44,660 | $46,630 |

| For a family of 9+ | Add $4,540 for each extra person | Add $4,720 for each extra person |

Note: Federal Poverty Level amounts are higher in Alaska and Hawaii. See all HHS poverty guidelines for 2022.

How federal poverty levels are used to determine eligibility for reduced-cost health coverage

- Income above 400% FPL: If your income is above 400% FPL, you may now qualify for premium tax credits that lower your monthly premium for a 2022 Marketplace health insurance plan.

- Income between 100% and 400% FPL: If your income is in this range, in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan.

- Income at or below 150% FPL: If your income falls at or below 150% FPL in your state and you’re not eligible for Medicaid or CHIP, you may qualify to enroll in or change Marketplace coverage through a Special Enrollment Period.

- Income below 138% FPL: If your income is below 138% FPL and your state has expanded Medicaid coverage, you qualify for Medicaid based only on your income.

- Income below 100% FPL: If your income falls below 100% FPL, you probably won’t qualify for savings on a Marketplace health insurance plan or for income-based Medicaid.

“Income” above refers to

. For most people, it’s the same or very similar to

. MAGI isn’t a number on your tax return.

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

FPL Chart - 2024

Download: 2024 ACA Cheat Sheet with FPL Amounts

Federal poverty level (FPL)

Federal Poverty Level (FPL)

| Family size | 2022 income numbers | 2023 income numbers |

|---|---|---|

| For individuals | $13,590 | $14,580 |

| For a family of 2 | $18,310 | $19,720 |

| For a family of 3 | $23,030 | $24,860 |

| For a family of 4 | $27,750 | $30,000 |

| For a family of 5 | $32,470 | $35,140 |

| For a family of 6 | $37,190 | $40,280 |

| For a family of 7 | $41,910 | $45,420 |

| For a family of 8 | $46,630 | $50,560 |

| For a family of 9+ | Add $4,720 for each extra person | Add $5,140 for each extra person |

How federal poverty levels are used to determine eligibility for reduced-cost health coverage

- Income above 400% FPL: If your income is above 400% FPL, you may now qualify for premium tax credits that lower your monthly premium for a 2023 Marketplace health insurance plan.

- Income between 100% and 400% FPL: If your income is in this range, in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan.

- Income at or below 150% FPL: If your income falls at or below 150% FPL in your state and you’re not eligible for Medicaid or CHIP, you may qualify to enroll in or change Marketplace coverage through a Special Enrollment Period.

- Income below 138% FPL: If your income is below 138% FPL and your state has expanded Medicaid coverage, you qualify for Medicaid based only on your income.

- Income below 100% FPL: If your income falls below 100% FPL, you probably won’t qualify for savings on a Marketplace health insurance plan or for income-based Medicaid.

“Income” above refers to

. For most people, it’s the same or very similar to

. MAGI isn’t a number on your tax return.

Related content

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.