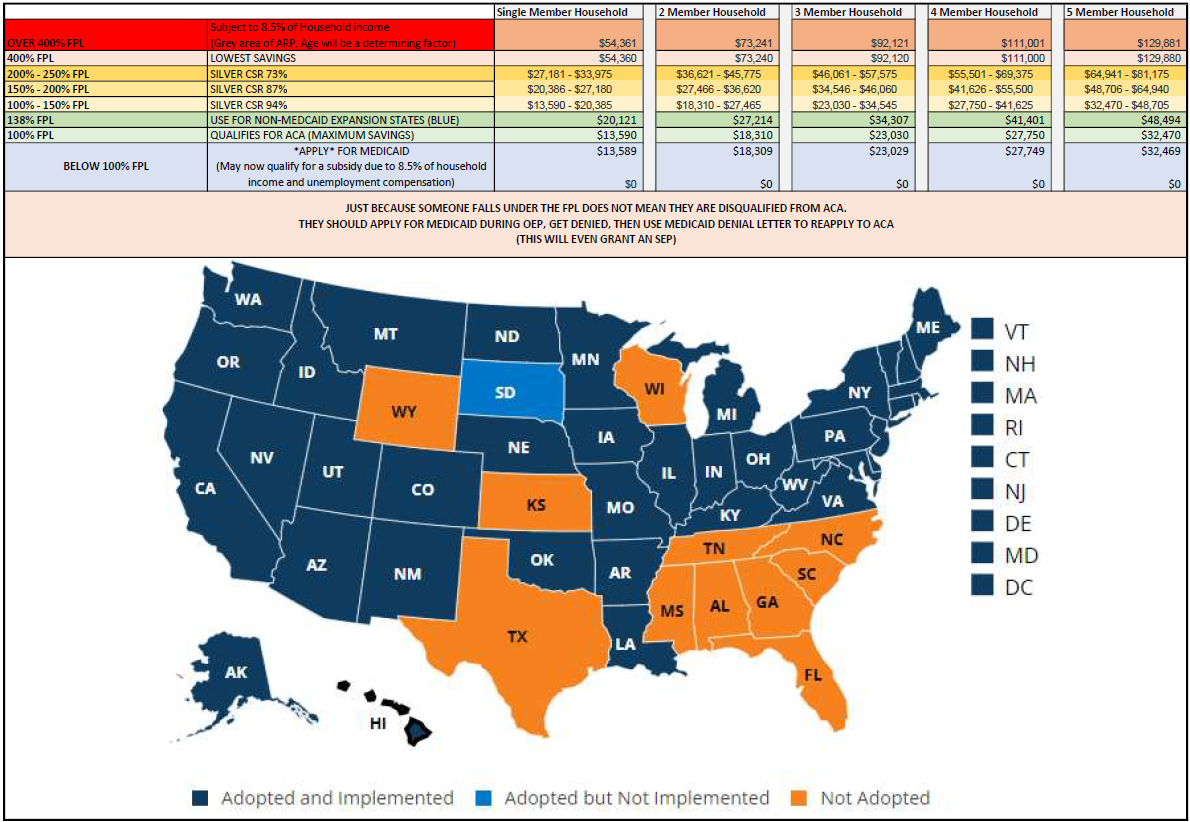

Download: ACA Cheat Sheet with FPL Amounts

Federal poverty level (FPL)

A measure of income issued every year by the Department of Health and Human Services (HHS). Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage.

The 2022 federal poverty level (FPL) income numbers below are used to calculate eligibility for Medicaid and the Children’s Health Insurance Program (CHIP). 2021 numbers are slightly lower, and are used to calculate savings on Marketplace insurance plans for 2022.

Federal Poverty Level (FPL)

| Family size | 2021 income number | 2022 income numbers |

|---|---|---|

| For individuals | $12,880 | $13,590 |

| For a family of 2 | $17,420 | $18,310 |

| For a family of 3 | $21,960 | $23,030 |

| For a family of 4 | $26,500 | $27,750 |

| For a family of 5 | $31,040 | $32,470 |

| For a family of 6 | $35,580 | $37,190 |

| For a family of 7 | $40,120 | $41,910 |

| For a family of 8 | $44,660 | $46,630 |

| For a family of 9+ | Add $4,540 for each extra person | Add $4,720 for each extra person |

Note: Federal Poverty Level amounts are higher in Alaska and Hawaii. See all HHS poverty guidelines for 2022.

How federal poverty levels are used to determine eligibility for reduced-cost health coverage

- Income above 400% FPL: If your income is above 400% FPL, you may now qualify for premium tax credits that lower your monthly premium for a 2022 Marketplace health insurance plan.

- Income between 100% and 400% FPL: If your income is in this range, in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan.

- Income at or below 150% FPL: If your income falls at or below 150% FPL in your state and you’re not eligible for Medicaid or CHIP, you may qualify to enroll in or change Marketplace coverage through a Special Enrollment Period.

- Income below 138% FPL: If your income is below 138% FPL and your state has expanded Medicaid coverage, you qualify for Medicaid based only on your income.

- Income below 100% FPL: If your income falls below 100% FPL, you probably won’t qualify for savings on a Marketplace health insurance plan or for income-based Medicaid.

“Income” above refers to

. For most people, it’s the same or very similar to

. MAGI isn’t a number on your tax return.